Capital Gains Tax Rate 2020

Capital Gains Tax Rate 2020. To illustrate, say you are a single taxpayer in 2020 with wages. Denmark levies the highest capital gains tax of all countries covered, at a rate of 42 percent. The rate you'll pay depends on your filing status and total taxable the income ranges for different brackets by filing status.

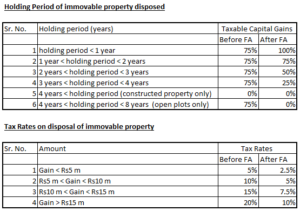

An aspect of fiscal policy. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. Find the capital gains tax rate for each state in 2020 and 2021. This section explains the capital gains tax rates for gains realised after the new tax rules (in force from the 6th of april 2019). The capital gains tax rate for tax year 2020 ranges from 0% to 28%.

The tax rates on capital gains and dividends depend on how long you hold an investment, your taxable income and filing status.

Prepare your 2020 taxes on efile.com now and we will calculate, determine, and report all of this information for you. The categorisation between the short term capital gains( stcg ) and long term capital gains( ltcg ) is very much crucial as this determines the capital gains tax rate. Here are the details on capital gains rates for the 2020 and 2021 tax years. Capital gains can be either long term or short term. An aspect of fiscal policy. Here are the capital gains taxable income thresholds for the 2020 tax year Long term capital gain tax. Capital gains taxes are paid when an asset is sold, and are applied to the amount of appreciation on the asset from when it was bought to when it is sold. This section explains the capital gains tax rates for gains realised after the new tax rules (in force from the 6th of april 2019). Learn more about options for deferring capital gains taxes. Capital gains tax is a levy on the difference between an asset's purchase price and sale price.

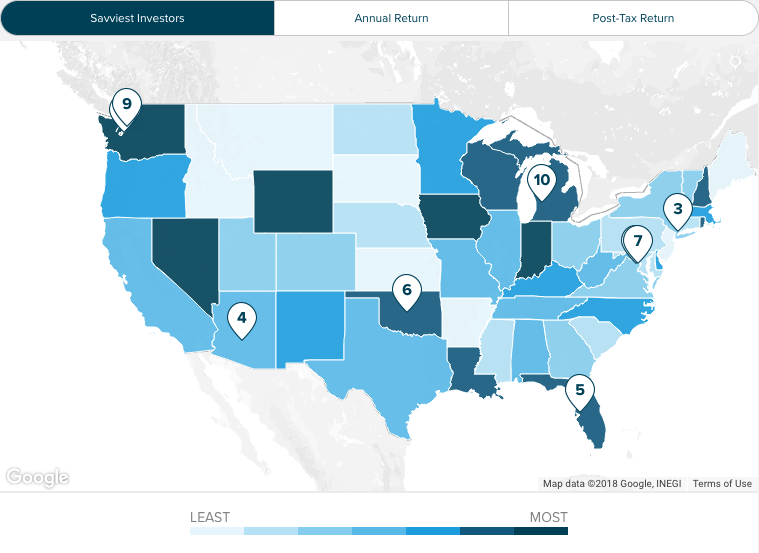

This section explains the capital gains tax rates for gains realised after the new tax rules (in force from the 6th of april 2019). Capital gains can be either long term or short term. Find the capital gains tax rate for each state in 2020 and 2021. Here are the capital gains taxable income thresholds for the 2020 tax year Finland and ireland follow, at 34 percent and 33. Denmark levies the highest capital gains tax of all countries covered, at a rate of 42 percent.

Looking at the current tax system in the u.s.

An aspect of fiscal policy. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. Finland and ireland follow, at 34 percent and 33. However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. You may owe capital gains taxes if you sold stocks, real estate or other investments. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. The actual rates didn't change for 2020, but the income brackets did adjust slightly. Find the capital gains tax rate for each state in 2020 and 2021. For most people, the capital gains tax does not exceed 15%.

For the filing deadline of april 15, 2021, the. An aspect of fiscal policy. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs audit. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. There are a few other exceptions where capital gains may be taxed at rates greater than 20% However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. Denmark levies the highest capital gains tax of all countries covered, at a rate of 42 percent.

Here are the 2020 capital gains tax rates.

The higher your income, the higher the rate. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. Looking at the current tax system in the u.s. Moreover, capital gains tax rates are often lower than tax rates on wages, investment interest, and other types of income. You may owe capital gains taxes if you sold stocks, real estate or other investments. For most people, the capital gains tax does not exceed 15%. You will pay 10% capital gains tax (or 18% on residential property) if the amount is within the basic income tax band for 2020 to 2021 tax year. Half of a capital gain constitutes a taxable capital gain, which is included in the corporation's income and taxed at ordinary rates. Capital gains tax applies to both individuals and businesses. This 15% rate applies to individuals and couples who earn at least $80,000 and whose income does not exceed $441,500 for single filers or $496. Capital gains tax is a levy on the difference between an asset's purchase price and sale price. Here are the capital gains taxable income thresholds for the 2020 tax year Find the capital gains tax rate for each state in 2020 and 2021.

Half of a capital gain constitutes a taxable capital gain, which is included in the corporation's income and taxed at ordinary rates capital gains tax. Capital gains can be either long term or short term.

Posting Komentar untuk "Capital Gains Tax Rate 2020"